E-Commerce Course Description

This E-Commerce course is an Open Educational Resource presented by RM Nisperos.

The course is a resource for the Introduction to E-Commerce Certification Course of the University of the Philippines Open University.

Table of Contents

E-Commerce Fundamentals

We will dive into Electronic Commerce, or E-commerce, as we will later refer to succeeding topics. This topic starts by laying out the context of what e-commerce is, how e-commerce began, and how it evolved into what we know now. You will discover a deeper understanding of e-commerce and how it differs from traditional physical business.

But before diving into e-commerce, remember that an e-commerce business is just any other business that should be grounded by business fundamentals of marketing, operations and finance. The video below explains the business foundation that an entrepreneur should know before operating an e-commerce business.

E-Commerce Expanded Definition

What is electronic commerce or simply e-commerce? Most people narrowly define it as the selling of physical goods via the Internet or retailing via the Internet. The definition of e-commerce is the buying and selling of goods and services via electronic technology without physical contact between the seller and the buyer. Before the advent of the internet, the technology used landline telephones and mobile phones.

Anything electronic transaction that is for selling or buying can be said to be e-commerce. We won’t know what technology will happen that could supplant the internet, which drives electronic commerce. But for this era, we’ll settle on the internet as the main enabler of electronics in the Philippines, though there is still e-commerce made through telephone calls and Short Message Services (SMS).

It is easy to understand that e-commerce is a transaction that uses electronic means, while traditional commerce is the face-to-face exchange of goods and services. That delineation used to be the norm, but today, that is now blurred by the fact that sophisticated businesses use the internet to power their physical stores. If you look into it, the transaction is technically done via electronic means, but there is a face-to-face interaction between the seller and the buyer and even the concerned goods or services. Our definition of e-commerce is strictly for buying and selling transactions done electronically without physical interaction between seller and buyers.

It is common practice for a business to have an online store coinciding with its physical store. Any customer can purchase depending on their preferences. Take into consideration Cebu Pacific Airlines. They have an online booking website where you can buy flights and even make check-ins. Cebu Pacific also has mobile applications in Android Playstore and Apple iTunes, where you can also book and check in flights. Complementary to those mentioned, they also have physical stores where you can buy flight tickets depending on their availability. They also have satellite offices and resellers where they utilize the system used by the website for ticket reservations.

In our definition, we should consider the online booking website and the Android and iTunes mobile applications as e-commerce since both facilitated transactions via electronic technology (internet) without physical interaction between seller and buyer. Apparently, entrepreneurs consider only the online booking website as e-commerce but not mobile applications. It is still e-commerce, though it is more sophisticated in the electronic medium used.

The transactions in the Cebu Pacific physical store should be considered the traditional brick-and-mortar setup. At the same time, the satellite offices and resellers utilize the same technology used by websites and apps as a hybrid between the two. The difference between the hybrid isn’t noticeable in Cebu Pacific. It can be, however, noticeable in a more technologically advanced example in the form of Amazon Go, where customers can enter a store, get all the things they need, and leave the store without checking out in the queue. The hybrid store was made possible by electronic technology connected to the store full of cameras, their Amazon account, and their bank accounts. Well, it’s too much of an example of e-commerce here in the Philippines, but I hope you understand.

E-Commerce History

Electronic commerce is the buying and selling of goods and services through electronic means without physical interaction between the buyer and the seller. With its origin in Electronic Data Interchange and Electronic Fund Transfer (EFT), e-commerce today has become a lucrative industry where everything you can imagine can now be bought via the internet.

The initial e-commerce boom here in the Philippines was dominated by classified ads websites where merchants could post advertisements or offers. Sulit and Ayos Dito classified ads website dominated the 2000s e-commerce landscape in the Philippines. Then, the airline industry innovated online airline ticket selling. Filipinos were introduced to e-commerce due to the popularity of the piso fare that highlighted this era.

Unique offers in the form of group discounts popularized by Groupon, Metrodeal, and other similar sites helped push the adoption of Philippine e-commerce.

Before the pandemic hit, Philippine e-commerce adoption was not that high. Filipinos love to shop physically, so they need to use all their senses for their buying experience. Because of the pandemic, Filipinos had no choice but to adapt. The pandemic increased the adoption of buying online. Social media selling became the norm. Getting groceries online became famous.

Today, marketplace e-commerce dominates the Philippine e-commerce industry due to the low-cost selling requirements through popular apps like Lazada and Shopee.

E-Commerce Customer Journey

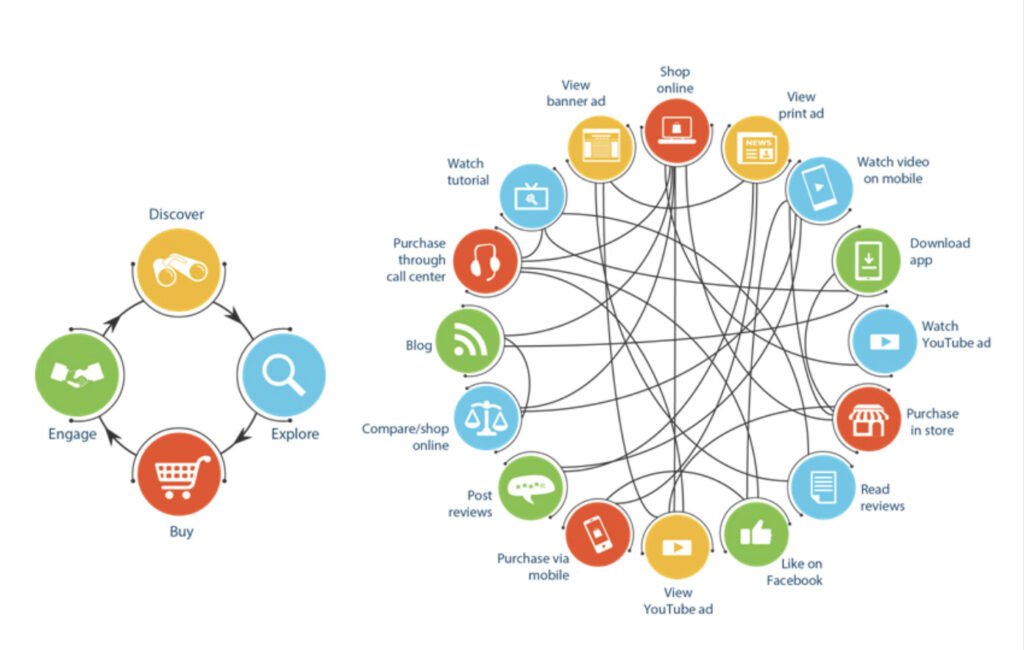

In general, how e-commerce works is similar to traditional physical stores. Customers go to the store of their choice, pick what they desire, pay for their purchases and enjoy what they buy. This is the timeless cycle customers go through when dealing with any business. In e-commerce, however, the means have expanded from just the physical retail shop to an array of digital and electronic means.

This complex means to purchase goods and services, resulting in more choices for customers that make their buying experience more pleasurable and convenient. Imagine what buyers can do is access their laptops, tablets, and mobile phones to purchase. They don’t need to dress up and travel to stores selling the same things he/she bought. While these innovations make e-commerce simpler and more convenient for buyers, it has become more complex for sellers since they added processes in information technology, database management, digital marketing, website and application development, and administration.

According to Business2Community, the e-commerce customer experience is all about personalization. A shopping journey now replaces the traditional customer pattern where customers can cross over different touchpoints. A consumer may visit your e-commerce website, but they are not limited to visiting other reviews, videos, and another store that share the same products.

To communicate effectively across all channels, e-commerce businesses must connect those touch-points with omnichannel technology to fulfill customers’ increasing demand for instant information on any subject matter. The image below illustrates the communication between various channels in completing today’s digital customer lifecycle.

State of Philippine E-Commerce

For the state of Philippine E-Commerce, refer to the Slideshare on the Philippine market:

Philippine E-Commerce Policies

The landmark E-Commerce Law was passed in June 2000, signaling the start of an e-commerce era for the Philippines. The law gave official government recognition to various electronic transactions circulating in the Philippines. Since then, laws have been passed to regulate and improve the e-commerce industry in the Philippines. While the government considers an E-Commerce business as a typical business in the Philippines, additional laws apply. The most recent of which is shown in the video above.

Philippine E-Commerce Laws

E-Commerce Law of 2000

Since the E-Commerce Law was enacted in 2000, many laws and policies have been enacted as implementing guidelines. Government commissions and committees, public-private councils and government offices were created to execute the said implantation guidelines. Though its initial implementation focused on the development of the BPO industry, the succeeding laws passed eventually to promote and regulate e-commerce focused on the Filipino mass market.

According to Janet Toral of Digital Filipino, the salient features of Republic Act 8792 are:

- It gives legal recognition of electronic data messages, electronic documents, and electronic signatures. (sections 6 to 13)

- Allows the formation of contracts in electronic form. (section 16)

- Makes banking transactions done through ATM switching networks absolute once consummated. (section 16)

- Parties are given the right to choose the type and level of security methods that suit their needs. (section 24)

- Provides the mandate for the electronic implementation of transport documents to facilitate the carriage of goods. This includes documents such as, but not limited to, multi-modal, airport, road, rail, inland waterway, courier, post receipts, transport documents issued by freight forwarders, marine/ocean bill of lading, non-negotiable seaway bill, charter party bill of lading. (sections 25 and 26)

- Mandates the government to have the capability to do e-commerce within 2 years or before June 19, 2002. (section 27)

- Mandates RPWeb to be implemented. RPWeb is a strategy that intends to connect all government offices to the Internet and provide universal access to the general public. The Department of Transportation and Communications, National Telecommunications Commission, and National Computer Center will come up with policies and rules that shall lead to a substantial reduction of costs of telecommunication and Internet facilities to ensure the implementation of RPWeb. (section 28)

- Made cable, broadcast, and physical wireless infrastructure within telecommunications. (section 28)

- Empowers the Department of Trade and Industry to supervise the development of e-commerce in the country. It can also develop policies and regulations, when needed, to facilitate the growth of e-commerce. (section 29)

- Provided guidelines as to when a service provider can be liable. (section 30)

- Authorities and parties with legal rights can only gain access to electronic documents, electronic data messages, and electronic signatures. For confidentiality purposes, it shall not share or convey to any other person. (sections 31 and 32)

- Hacking or cracking refers to unauthorized access, including the introduction of computer viruses, which is punishable by a fine from 100 thousand to a maximum commensurate to the damage. With imprisonment from 6 months to 3 years. (section 33)

- Piracy through telecommunication networks, such as the Internet, that infringes intellectual property rights is punishable. The penalties are the same as hacking. (section 33)

- All existing laws, such as the Consumer Act of the Philippines, also apply to e-commerce transactions. (section 33)

Data Privacy Act of 2012

Tells every Filipino that “Except for the purposes authorized under this Act, any person who obtained access to any electronic key, an electronic data message, or electronic document, book, register, correspondence, information, or other material pursuant to any powers conferred under this Act, shall not convey to or share the same with any other person. Learn More by clicking here

Consumer Protection Regulation – Transactions through E-Commerce

E-commerce merchants are required to adopt fair and reasonable business practices. Sell products that meet quality and safety guidelines. These products are authorized to be marketed in the Philippines, having the necessary permits or licenses. Learn More by clicking here

E-Commerce Advertising Regulations

Some of the basic regulations on advertising affecting e-commerce are:

- Selling of gift certificates can not have an expiration date

- Only registered businesses can do sales promotions, with or without purchase required

- Companies that conduct sales promotions without a permit or may have neglected during their promotion can be contacted by the consumer for resolution of the issue.

- E-commerce site owners are expected to practice fair and truthful advertising.

Cybercrime Act of 2012

This law addresses legal issues concerning online interactions and the Internet in the Philippines. The cybercrime offenses included in the bill are cybersquatting, cybersex, child pornography, identity theft, illegal access to data and libel. For more info click here

Tax-Related Guidelines on E-Commerce Businesses

E-Commerce Business Owners are required to issue invoices or official receipts to customers. Give acknowledgment receipt for the amount received from payment gateways. Pay the commission of payment gateways net of withholding tax. For a more detailed explanation visit here

E-Commerce Drivers and Inhibitors

The success and failure of Philippine e-commerce hinge on the factors enumerated in the UNCTAD report: internet capabilities, credit card penetration, domestic servers or postal service capabilities. While these are macro factors that the government should improve, there are a lot of specific factors that the private sector should consider.

The following factors in this topic should concern small and big e-commerce players to improve not only the probability of their e-commerce ventures but also the improvement of the e-commerce industry as well. Bill Anckar listed and briefly explained the most commonly beneficial and detrimental factors (directly quoted from the study):

E-Commerce Drivers

Accessibility and convenience. The possibility to shop anytime, from anywhere is the most prominent and most commonly cited advantage of e-commerce and was found to be the most important perceived consumer benefit of Internet shopping in empirical studies by Jarvenpaa and Todd (1996- 1997) and Kangis and Rankin (1996).

Global choice. Since the boundaries of e-commerce are not defined by geography or national borders, consumers will benefit from a wide selection of vendors and products – including a wider availability of hard-to-find products (Benjamin & Wigand 1995, Hoffman et al. 1995, Alba et al. 1997).

Online delivery. For digital products, the whole commercial cycle, including distribution, can be conducted via a network, providing instant product access immediately when needed.

Test and trial online. Digital products can be tested over the Internet before making purchase decisions, reducing uncertainty.

The real-time nature of the medium. The Internet can provide consumers with up-to-the-minute information on prices, availability, etc. (cf. Franz 2000).

Time savings. Consumers may benefit from the shopping process being faster in the market space than in the marketplace due to the rapidity of the search process and the transactions (Wigand & Benjamin 1995, Krause 1998).

Possibilities for comparison shopping. By allowing consumers to shop in many places and conduct quick comparisons of offerings and prices (Hoffman et al. 1995, Hart et al. 2000), Internet marketplaces can reduce search costs for price and product information (Bakos 1998, Strader & Shaw 1999, Rowley 2000, Bhatt & Emdad 2001). Access to extensive information. An important consumer benefit is access to more dynamic information to support queries for consumer decision-making (Hoffman et al. 1995, Alba et al. 1997).

Privacy and anonymity. The Internet can offer consumers benefits concerning partial or even total privacy and anonymity/pseudonymity (Parsons 2002) throughout the purchasing process.

Competitive prices. By embracing e-commerce, consumers may benefit from price reductions as a result of increased competition as more suppliers can compete in an electronically open marketplace (Turban et al. 1999), as a result of reduced selling prices due to a reduction in operational/transaction costs (Brynjolfsson & Smith 2000), and manufacturers internalizing activities traditionally performed by intermediaries (Benjamin & Wigand 1995).

Availability of personalized offerings. Consumers can benefit from IT-enabled opportunities for personalized interactions and one-to-one relationships with companies, allowing products, services and Web content to be customized more easily (cf. Peppers & Rogers 1999, Brown 2000).

The social nature of the purchasing process. Since consumers differ in their social disposition, many customers may find an impersonal purchasing situation desirable for social reasons or simply because they find verbal contact with a seller time-consuming. Moreover, the lack of physical sellers creates a sales setting with virtually no pressure to buy (Zellweger 1997).

E-Commerce Inhibitors

Quality evaluation. On the Internet, it is more or less impossible to make sure, beyond doubt, those (tangible) products have the desired features (e.g. design, material, color, fit), giving rise to a quality evaluation barrier to e-commerce. Empirical findings by Kangis and Rankin (1996) showed that the need to feel and touch was the dominating disadvantage for all home shopping services.

Security risks. It has been suggested that transaction security (such as the credit card number being picked up by third-party hackers) is mostly a perceptual problem in e-commerce (Rose et al. 1999). Nevertheless, the fact remains that it may be one of the more complex barriers to be overcome (Zwass 1996, Alridge et al. 1997, Reedy et al. 2000), as studies show that adopters, as well as non-adopters of Internet shopping, have security worries (Furnell & Karweni 1999, Udo 2001, Fenech & O’Cass 2001).

Lack of trust in virtual sellers. The fear of fraud and risk of loss has commonly been cited as a significant barrier to B2C e-commerce, with empirical research supporting this assumption (see Jarvenpaa & Todd 1996-1997, Furnell & Karweni 1999, Hoffman et al. 1999, Vijayasarathy & Jones 2000a).

Delivery times. Intangible product categories, any home-shopping method involves delivery times which means that the Internet is at a disadvantage to physical stores as it fails to meet the customers’ need for instant gratification (Vassos 1996). Consumers may thus be reluctant to wait for the delivery of ordered goods for days/weeks if the same product can be collected immediately in physical outlets.

Lack of personal service. While e-commerce offers great opportunities for one-to-one marketing, it significantly reduces or even puts an end to the personal service (human-to-human contact) characterizing traditional commerce. This may, as suggested by research by Kangis & Rankin (1996), be an impediment to e-commerce for many consumers.

Lack of enjoyment in shopping. Many consumers find the shopping experience – looking, feeling, comparing – in retail stores relaxing and enjoyable (Jones, 1999). As the feeling of amusement and relaxation is unlikely to be as marked in electronic settings, e-shopping can hardly be seen as a substitute for the leisure experience associated with conventional shopping (Phau & Poon 2000).

Hard to find what you are looking for. The difficulty in locating stores/products/information on the Web (cf. Jarvenpaa & Todd 1996-1997, Rose et al. 1999) emerges from user limitations, search engines used, or poor site usability.

Time-consuming nature. As noted, e-commerce may offer consumers savings in time. However, using the Internet for commercial purposes may be too time-consuming for many users (see Anckar & Walden 2002). There are multiple reasons for this: (i) difficulties locating Web sites/products/services (Hofacker 2001); (ii) registration procedures required to access services; and (iii) making price comparisons (cf. Reedy et al. 2000).

The cost of entry. Cost of acquiring a computer, etc.

The cost of use. Internet access fees.

Limited Internet/ computer experience. Reluctance/difficulties operating computers and/or browsing the Web.

Poor connection speed. Due to low bandwidth connections, using the Internet may be time-consuming and thus frustrating.

Philippine E-Commerce Roadmap

The DTI Secretary said “Platforms like Alibaba have opened up markets to hundreds of millions of MSMEs in China, contributing to the alleviation of poverty by creating jobs in the economy. We should follow that track in the Philippines…Through the Internet, they can find customers, export, and don’t have to deal with customs. This kind of e-commerce platform is what we have to promote. That will be a big boost to our MSMEs.”

The E-Commerce Roadmap, spearheaded by the Department of Trade and Industry, addresses the identified factors that impede the development of the Philippine e-commerce industry both in the macro and micro view. The government highlights the roadmap’s importance as an integral piece in catalyzing growth and globalization, especially for micro, small, and medium enterprises (MSMEs).

This landmark policy for the e-commerce industry of the Philippines provides opportunities for established businesses, MSMEs and Filipinos wanting to start an e-commerce business. Since 99.6% of Philippine enterprises are made up of micro, small, and medium enterprises (MSMEs), they will largely benefit from this initiative. By participating and engaging in e-commerce programs and projects, Philippine MSMEs can have more opportunities to grow their income, resulting in a good economy as well. This also decreases the chances of failure, which is high for new businesses and MSMEs.

According to the DTI, The roadmap’s main objective is to contribute 25% to the Philippines’ gross domestic product (GDP) by 2020 (from 10% in 2015 based on estimates made by iMetrics Asia Pacific Corporation). Specific objectives of the e-commerce roadmap are the following:

Specifically, the e-commerce roadmap identifies the areas the government will prioritize and improve to achieve the grandiose objectives mentioned above.

- Infrastructure: The need for an appropriate supply chain, communications, and applications infrastructure. Deliverables on this initiative are:

- Investment: The ability to promote and support a range of investment opportunities, from Foreign Direct Investment to capital flows;

- Innovation: The ability to foster and support innovation, including the ability to protect innovation and investment in research and development;

- Intellectual Capital: The ability to foster the appropriate skills and training from technological to linguistic to entrepreneurship;

- Information Flow: The ability to use, transfer, and process information – the currency of the digital economy – while promoting privacy and a trusted Internet environment and

- Integration: The ability to connect domestic industries with the global economy.

Specific Deliverables of the E-Commerce Roadmap are the following:

The e-commerce roadmap provides opportunities for entrepreneurs to improve their businesses through e-commerce. This government initiative provides more reasons to prepare for an e-commerce boom in the Philippines.

View the E-Commerce Road Map Here

Pillars of E-Commerce

An e-commerce business journey begins with understanding the 4 pillars of e-commerce. These pillars are the critical success factors of any starting or growing e-commerce business. These pillars are electronic stores, logistics, digital marketing, and payment gateway.

An e-commerce business is driven by these pillars that act as the foundation of its existence. These e-commerce pillars are like posts that strengthen a bridge enabling it to support travelers. The absence of these pillars and the e-commerce business will not function properly, much like the bridge analogy. The strength of any e-commerce business is not measured by the overall strength of the pillars altogether but by the strength of the weakest pillar. It is similar to a supply chain principle where the overall strength is as strong as its weakest link – like a chain breaking on the weakest link.

Electronic Store

E-commerce is called such due to this unique characteristic differentiating them from traditional brick-and-mortar stores. An electronic store is a marketing channel, platform, or tool that is hosted electronically where merchants can showcase their products or services for which consumer transactions can be generated electronically without physical interaction.

Websites

The most common electronic store used in e-commerce is websites. This kind of electronic store is best known for electronic shopping carts where users are allowed to place items. Most of the time, it remembers these items for a predetermined length of time until the items are checked out for payment. Examples in the Philippines are Lazada, Zalora, Metrodeal, Cebu Pacific, Lamudi, Carmudi, OLX, and ZipMatch.

Social Media

Another form of electronic stores is based on social media platforms, more prominently on Instagram and Facebook. This kind of electronic store follows the specific features of each social media platform. Like in Facebook stores, it can act similarly to websites since it can have integrated carts that automate the selling process. On Instagram, there aren’t any e-commerce capabilities. Thus, all transactions are conducted online. The benefit of using social media shops is the relationship and trust. Customers are still reluctant to purchase via websites due to fraud and security concerns. The communication lines that social media has between the seller and customers address the said concerns. With a big user base of such social media platforms, customers are easy to find. The drawback, arguably, in social media-based stores is the level of control. Entrepreneurs are at the mercy of the platforms.

Marketplaces

You can also have an e-commerce business without needing an electronic store. One can post their products in e-commerce marketplaces such as Amazon, Lazada, OLX, eBay and other smaller marketplaces. This kind of e-commerce piggybacks on famous marketplaces where traffic and purchases are enormous. Analogously, this is similar to distributing products via big retailers such as SM and Robinsons Department Stores. This time, products are listed in marketplaces.

Another electronic store could be made via Mobile Applications downloadable in Google Playstore, iOS marketplace and Microsoft apps. While this is a feasible alternative, the Philippines’ adoption of mobile shopping via apps is still not that big. This mostly applies to super niche products and services done by software applications.

Omni Channels

Another form of e-commerce that is emerging is Omnichannel. These kinds of e-commerce combine all electronic store alternatives with traditional brick-and-mortar stores. The difference is the integration between channels. Customers will have a seamless shopping experience even if they change how they shop. E-commerce Omnichannel provides the same information regardless of the store (electronic and brick and mortar).

Payment Gateways

Payment gateways are service providers facilitating electronic payment made by customers via credit cards for the products or services they bought from electronic stores. Since electronic payments via credit cards are only processed by issuing and acquiring banks through electronic settlement platforms, there is no way an e-commerce store can process payments on its own. These services in accepting customer payments are an important function in completing an e-commerce transaction cycle.

Accepting credit card payments is the best practice in accepting electronic payments in e-commerce stores. Due to its complexity and regulatory concerns, a typical small and medium enterprise cannot easily subscribe to standard practice. This resulted in alternative payment gateways to service all e-commerce in all forms and sizes.

Logistics

Logistics – a field in supply chain management – is the process that involves procurement, storage, and delivery of products and services. Logistics also involves but is not limited to, transportation, fulfillment models, warehousing, inventory management, shipping and product returns, and so on. While the e-commerce store showcases the product and services ready for purchase, logistics enable customers to enjoy the benefits of it. At the very least, logistics’ main concerns are that customers receive their purchases depending on their needs and that, simultaneously, optimize the profitability of the e-commerce business.

Big e-commerce businesses usually own their logistics to have full control, while some outsource logistics totally through reliable third-party logistics providers. In this section, logistics shall be explained thoroughly.

Digital Marketing

Marketing is simply getting value by meeting human needs. It is the art and science of choosing and getting, keeping, and growing customers through creating, delivering, and communicating superior customer value. In general definition, it is meeting human needs profitably through the art of selling.

In e-commerce, it is not enough to have an electronic store. Entrepreneurs need to educate their target market that their business exists. With the number of e-commerce sites increasing exponentially, marketing is becoming increasingly essential to obtain the target market’s attention.

It is typical for a business hosted electronically to find customers that adopt the technology. A business online should at least have a strategy to target markets spending time on online technology platforms. With the world shifting from analog to digital, e-commerce puts premiums in marketing tactics centered on digital mediums such as, but not limited to, search engines, content websites, social media, and online video streaming, among others.

E-Commerce Business Idea Development

This part of the course discusses how to build e-commerce concepts, from market segmentation and targeting to mining problems and customer discovery interviews, to develop a viable idea. With the numerous guides available on the internet on how to start an e-commerce business, the challenge for entrepreneurs is to come up with a good e-commerce business idea and the development of it until it can be worthy of an investment.

9 out of 10 businesses fail to sustain operations a year after their inception. One of the often overlooked reasons is the concept entrepreneurs are trying to pursue. Many attribute the failure to success to how well the e-commerce pillars are set up. However, a bad e-commerce idea may set an entrepreneur to failure.

Market Segmentation

Market segmentation is classifying customers via attributes and characteristics critical to your business. Market segmentation is important in any industry – e-commerce or traditional – because it enables businesses to know precisely how to reach customers with specific needs and wants.

Every good e-commerce business starts with a target market in mind. It is not the creation of a market segment but the identification of the best ones for a better chance of building the next big thing. By using market segmentation, an e-commerce business can narrow its options and lay out specific paths to have more probability of success.

Market Targeting

While market segmentation is grouping a specific set of customers, market targeting is picking the right customer segments for an e-commerce business to be successful. E-commerce businesses have every right to choose most, if not all, customer segments. However, choosing specific customer segments enables an e-commerce business to minimize the probability of failure because it can produce or serve a specific set of needs and wants.

Mining for Business Ideas

The internet resulted in lots of information that is a gold mine for e-commerce entrepreneurs. This fact is mostly taken for granted and not properly utilized for market research. Data mining for e-commerce business idea development is pattern and idea discovery from the vast public data available on the internet.

There are lots of reviews available, market insights and problems waiting to be discovered. This section discusses a new and actionable method to conduct market research to determine the needs and wants of the chosen market segment.

Customer Development

A successful e-commerce business is a quest for an idea relevant enough to build a business on. But this is easier said than done. Most e-commerce businesses fail to consider what true customer needs and wants are. More often, entrepreneurs have this cognitive bias where they focus on information that tends to back up their beliefs about a topic or idea. In an e-commerce business, what customers want is the only thing that matters and not what the e-commerce entrepreneurs think. E-commerce business is not about what the e-commerce entrepreneurs’ passions are; it is about discovering the passion of the customers. An excellent e-commerce venture is about developing the market first before developing the business.

Customer interviews are structured conversations with potential customers that teach you much about your target audience. For developing an e-commerce idea, it is important to contact potential customers as quickly and often as possible. Interviews enable one to see ideas in the eyes of the customers. This will unravel insights and problems that could be greatly important in building your e-commerce business. At the minimum, the customer interviews can validate and falsify the ideas you developed in the previous section. This enables entrepreneurs to quickly find out feedback about their ideas even before building their e-commerce businesses.

E-Commerce Business Model Development

The e-commerce business hinges on technology as its driver for success. With that fact, most traditional business practices apply but not with similar success to traditional brick-and-mortar stores. Speed and agility, notwithstanding the uncertainty in developing online businesses, make it difficult for traditional business practices to fit into the exponentially changing e-commerce dynamics. That said, this topic fits a new set of business planning frameworks better suited for the evolving needs of online e-commerce demands.

Business Models

The business model is the mechanism that generates value or profit for a business. While the business plan is a document that presents and describes goals to achieve a strategy and expected financial performance under a set of assumptions, a business model describes the interplay among critical business areas considering the uncertainty of the market it operates.

Business Model Canvas

The Business Model Canvas is a strategic and entrepreneurial management template for developing new or documenting existing business models. It is a visual chart with elements describing a firm’s or product’s mechanism for creating, delivering and obtaining value from a specific set of customer segments. It is characterized by a one-page template that catches all 9 building blocks of a business model. The Business Model Canvas generally provides the structure of a business plan without too much writing and with the improvisation of a ‘back of the napkin’ sketch.

The Business Model Canvas is popularly used by technology and e-commerce entrepreneurs for business model innovation. It is a district from traditional business planning in three aspects. It provides more focus since there is no need to write hundreds of business plan pages. It is flexible since parts are easily interchangeable due to its visual style. Lastly, it is a communication tool for a team of entrepreneurs to understand the business model of an e-commerce business.

Value Proposition Canvas

The Value Proposition Canvas is an additional canvas within the Business Model Canvas, visually zooming in on the value proposition and the customer segment building blocks. It is generally a visual business tool that can help you create, design and implement value propositions concerning the specific needs and wants of your customers.

The value proposition canvas is designed on customer experience and behavioral marketing approach by matching unique e-commerce offerings with the motivating factors in buying decisions. It aims to have a perfect fit between what the products and services should have and what the customers demand.

Managing E-Commerce Entrepreneurship

Business, in general, was characterized by reliance on forecasting and prediction. This is the heart and soul of business plans, where the financial forecast is the foundation of all management decisions. For decades, traditional management principles thrived to general management practices based on historical experience. As the world becomes accustomed to technological innovations and inventions, the application of forecasts and prediction-based management is dwindling, especially for technology-based businesses such as e-commerce. Market unpredictability and uncertainty have been at an all-time high, even though the barriers to entry in the online business industry are at an all-time low.

Most traditional management is not fully applicable to e-commerce entrepreneurship due to its uncertainty and the fast-paced innovation involved. There should be a framework that is suited for e-commerce entrepreneurship and innovation. This topic discusses an entrepreneurial management framework to leverage the uncertainty and unpredictability of markets.

Entrepreneurial Management Framework

Entrepreneurial management is a leadership framework designed specifically for twenty-first-century uncertainty with the use of a different set of tools that were based on different fields. Though it is not a replacement for traditional management concepts, it is a framework that embraces the rigorous part of innovation management and entrepreneurship.

Developing a business model that makes a profit is not just a creative writing exercise through the visual canvas learned earlier. E-commerce entrepreneurs’ can’t just put their best guesses on the canvases, wait for customers to believe their story and execute right to a tee. Unfortunately, building an e-commerce business does not work this way. The entrepreneurial management framework helps the entrepreneur in fact-finding to quash the assumptions and risks associated with the e-commerce venture.

E-Commerce Experimentation

At the heart of entrepreneurial management is testing the market to determine if there is a demand for the said product or simply checking if there is a product or service to market fit. In e-commerce, we are accustomed to the hit-and-miss approach where success depends on the market. However, starting an e-commerce venture is also a science and as much as an art. Experimentation for assumptions and the riskiest part of the business model is key if e-commerce entrepreneurs intend to manage all aspects of starting an e-commerce business.

In conducting experimentation in e-commerce businesses, prerequisites need to be satisfied to be called an experiment and to have the intended impact in the end. It needs a falsifiable hypothesis in the experiment that will try to prove or disprove. It also needs the customer segment to gather feedback and validations. Lastly, there should be an offer to customer segments to force action.

Electronic Store Development

The electronic industry, not only in the Philippines but also in the world, is continuously evolving at a rapid pace. Previously, e-commerce was purely associated with websites opened on desktops. A few years later, smartphones dominated the market, and the emergence of social media changed the dynamics of Philippine e-commerce. In this module, electronic store alternatives expanding from websites shall be discussed. Depending on the preference and the target market of every e-commerce business venture, e-commerce entrepreneurs can choose to develop electronic stores through social media such as Instagram and Facebook, e-commerce marketplaces such as Lazada and mobile applications. For existing brick-and-mortar businesses, Omnichannel shall also be explored.

Website-Based Electronic Store

In the Philippines, website-based e-commerce still dominates the online market. There is no choice for a business not to have a website, whether for selling or just for brand awareness. The Philippine e-commerce industry is still dominated by the likes of Lazada, Zalora and OLX regarding the volume of mass-market e-commerce transactions. With Filipinos getting increasingly acclimated to the use of technology, particularly mobile smartphones, businesses need more time to push their products online.

Social Media Based Stores

The turn of the century saw the emergence of social media, where people can interact and connect with friends on an online platform. Different social media platforms emerged, but Facebook stood the best of time. Many reports were made about the Philippines being a social media country. According to WeAreSocial.sg, Philippines tops the world in terms of hours spent daily on social media at 4.17 hours.

With the said Filipinos in social media platforms, it is fitting that many people started to use social media as electronic stores to sell items. Social media is not only used as a marketing promotion channel but as an actual e-commerce store. Instagram, Pinterest and Facebook are the most used social media platforms.

Marketplaces

E-commerce marketplaces are e-commerce websites that can accept third-party merchants to sell on their platforms. In the Philippines, examples of such are Lazada and OLX. A business without any capability to do e-commerce can now have it just by partnering with these marketplaces. Marketplaces can find customers online, with the merchants building a website on their own. This is a perfect option for businesses that don’t want to brand and market their products and want to sell to keep a modest profit margin. This section shall explore the marketplace alternatives and how to utilize them for the greatest advantage.

Mobile Commerce

With the increasing adoption of smartphones not only in the Philippines but also around the globe, application-based e-commerce has seen an uptick. These are applications hosted on ecosystems, particularly in the Android-based Play Store or iOS-based App Store. Though the Philippine adoption of selling via mobile apps is not yet on the level of social media-based or website-based, it is worthy of exploring due to trends in smartphone capabilities.

Omnichannel

Omnichannel e-commerce is the direction of the future of e-commerce. Omnichannel means doing business across different online e-commerce stores and traditional physical stores that deliver consistent and seamless experiences for the customers, factoring in their different requirements and needs.

Examples are often like these: a mobile app-based e-commerce store matches the responsive design of the website and social media, which should thematically reflect the look and feel inside the traditional brick-and-mortar store. These integrations span not just marketing but also operations processes. This is particularly beneficial for existing brick-and-mortar businesses to provide the best customer experience that results in bottom-line growth. This section explores the world of omnichannel e-commerce.

E-Commerce Launch and Growth Management

Once an e-commerce entrepreneur has developed an e-commerce store after conducting customer development and experimentation, the next step is to immediately to their target customers from the outset so that they can gain insights and sell more efficiently and potentially faster.

After paying too much attention to the technical aspects of your idea through customer development and experimentation, wrongly assuming that target customers will understand the e-commerce business the same way the founder/s’ understood, it could be detrimental to a startup e-commerce business. The principle in the launch is straightforward: communicate with the target customers to educate them about the solution you offer to their needs. Ingredients of these launches are the brand and its components, the promotional pitch, and launch marketing tactics. Often, an e-commerce business needs to treat the launch as another test to see its potential. The only way to measure the launch performance is through quantitative data.

Branding

The traditional definition of branding means to distinguish the goods of one producer from those of another. The brand is often confused as a name, term, sign, symbol, design, or a combination of them that intends to differentiate them from those of competitors. Due to the digital age, the definition of branding evolved to the subjective perception of value based on the sum of a person’s experiences with a product or company that ultimately influences that person’s sentiment and decisions in the marketplace. Branding today in the digital age is the holistic sum of customers’ experiences, composed of visual, tonal and behavioral brand components, many of which are shaped by interaction design.

Elevator Pitching

In launching an e-commerce business, a lot of networking is needed to introduce and even educate the target market on the benefits and value of a startup e-commerce business. It is important to have a quick introduction to the e-commerce business for sales and promotions. In these cases, an elevator pitch is very handy. An Elevator pitch is a sales or promotional speech given quickly to define an e-commerce business and its value proposition. It is called an elevator pitch mainly because it should not exceed the amount of time you spend inside an elevator. It is like giving a speech to a rushing investor, and an e-commerce entrepreneur only has 30 seconds to 1 minute to get an investment or at least land an appointment for a future sales presentation.

Legal Aspect in E-Commerce

Businesses fuel the Philippines economy. About 90% of the business in the Philippines is composed of micro, small and medium enterprises employing the majority of the Philippine labor force. Businesses play a major role in helping the country improve its economy through the payment of correct taxes and providing employment opportunities. It is the responsibility of every Filipino to pay taxes and legalize the operations of an e-commerce business. Registering a business is the true mark of a responsible Filipino e-commerce entrepreneur.

While the previous topic stated that an e-commerce entrepreneur should mitigate risks through preselling, it is not an excuse not to legalize operations. While it is acceptable not to register in customer development and market research using the entrepreneurial framework, the legalization of a business is not to register or not but a matter of when. Official registration enables the e-commerce business founders to satisfy their duty as Filipino citizens. More importantly, the legalization of a business provides a legal entity for the e-commerce business that will result in better creditability and trust in the eyes of the customers. This module explores the forms of businesses and other legal aspects of operating an e-commerce business.

Forms of Business

The Philippine Constitution states three structure options for new and starting e-commerce businesses. A sole Proprietorship, as the name suggests, is owned by a single person. Partnership, on the other hand, is owned by partners ranging from two to more. Lastly, Corporations are owned by five or more. There are differences and similarities among the structures. The unique characteristics of each structure are suited depending on the situation and objective of an e-commerce business.

Registering Your Business

When an e-commerce entrepreneur finally decides on the structure for the e-commerce business, a process of registration needs to be fulfilled to call the business officially registered. Any business must file necessary documents in the Bureau of Internal Revenue and the Local Government.

New businesses may avail exceptions to this process through the Barangay Micro Business Enterprise Law, where new businesses may not need to pay specific taxes for two years.

3 thoughts on “UPOU E-Commerce Course”

The information here is exactly what an e-commerce start up needs to atleast have a fighting chance in the already crowded market landscape of e-commerce in the Philippines. Thank You.

I appreciate your comment. Thanks!

Good post. Can supplement courses on e-commerce.